Latest News

Duration

- 09 Months

- 68 hrs online

- 12 hrs offline

Application Fee

₹5,000 + GSTProgramme Fee

₹80,000 + GST* No-Cost EMI Available *

Eligibility

For Indian Participants – Graduates from a recognized University (UGC/AICTE/DEC/AIU/State Government) in any discipline with Mathematics/Statistics up to 10+2 level.

For International Participants – Graduation or equivalent degree from any recognized University or Institution in their respective country.

Proficiency in English, spoken & written is mandatory.

2 years of work experience

Overview

This cutting-edge certificate programme seamlessly blends theory with real-world application, equipping professionals with advanced financial acumen. Delivered by industry experts and renowned faculty, the programme ensures a holistic understanding of financial strategies. Elevate your career and organizational impact through rigorous curriculum, case studies, and networking opportunities.

Personalised Career Counseling

Who Should Attend

Applied Finance Enthusiasts:

Tailored for professionals seeking a deeper understanding of applied finance concepts.

Managers and Decision-Makers:

Ideal for those with management responsibilities,

providing essential financial

decision-making skills.

Open to All Backgrounds:

This inclusive course offers valuable insights to all.

Assessment

2 Assignments | 4 Quizzes | Final Exam

To be awarded a certificate, participants must meet the below criteria:

- Score minimum 50% overall in assignments and quizzes.

- Mandatory Attendance should be 50%.

- Course Objectives

- Highlights

- Learning Outcomes

- Programme Benefits

Course Objectives

Develop advanced skills to tackle complex corporate finance challenges.

Equip professionals with insights in financial analysis, portfolio management, risk, and more.

Foster proactive thinking to navigate evolving risks in the finance function.

Stay updated on changing global investment scenarios in capital markets.

Instill strong ethical values and responsibility in participants.

Meet the demand for qualified finance professionals in an action-driven industry.

Pedagogy

Course Completion Certificate

Course Participation Certificate

Course Structure

- Introduction to financial statement analysis

- Balance sheet

- Income statement

- Cash flow statement

- Financial Statement Analysis: Analysis of Financial Ratios (Liquidity Ratios, Activity/Management Efficiency Ratios, Leverage Ratios, Profitability Ratios)

- Basic statistics for finance

- Exploratory analysis

- Basic regression analysis

- Time Value of Money (Future value, present value, annuity, perpetuity)

- Fixed Income Markets and related variables

- Bond Pricing and yield to maturity estimation

- Duration estimation (Macaulay and Modified Duration)

- Convexity and Bond Volatility

- Return, Risk, Covariance, risk premium

- Portfolio construction (two-asset portfolio and multi-assets portfolio)

- Minimum variance portfolio, Efficient frontier,

- Portfolio performance evaluation

- Market timing ability

- Dividend discount model

- Return on equity, Security Market Line (CAPM) (Cost of equity), Cost of debt, Analysis of Beta, Weighted Average cost of capital (WACC)

- Discounted Cash Flow Method (Free cash flow to firm based approach)

- Relative Valuation

- Trend indicators (moving averages, parabolic stop and reverse (SAR))

- Momentum indicators (MACD, RSI, CCI, SMI, %R etc.)

- Volatility indicators (Bollinger bands, Average true range etc.)

- Volume indicators (On Balance Volume, CAD)

- Backtesting

- Time series analysis- Return modelling and forecasting (AR, MA and ARMA models)

- Volatility modelling and forecasting (GARCH, GJR-GARCH and EGARCH models)

- Predicting stock returns based on accounting ratios

- Net present value (NPV)

- Internal rate of return (IRR)

- Payback period and discounted payback period

- Profitability index

- Financial model exercise for project feasibility evaluation and financing

- Futures and Forwards

- Hedging and speculation, Mark-to-market

- Futures/forward pricing

- Cross-hedging

- Options

- Hedging and speculation using options

- Option trading strategies

- Option pricing

- Delta hedging

- Interest rate swaps, Forward rate agreement, overnight indexed swap, Currency swaps

- M & A Process

- M & A Deal Valuation

- Strategic vs Financial Acquisition

Fee Structure

* No-Cost EMI Available *

| Total Course Fee | Installment 1* | Installment 2* |

| ₹80,000 + GST |

₹40,000 To be paid within 7 days after receiving the offer from the institute |

₹40,000 To be paid within 30 days from the registration fee paid date |

Refund Policy:

There is no Refund on Course Fees once the course begins. Prior to course commencement, if a student requests for a refund, the Registration Fees are deducted and the remaining amount is refunded.

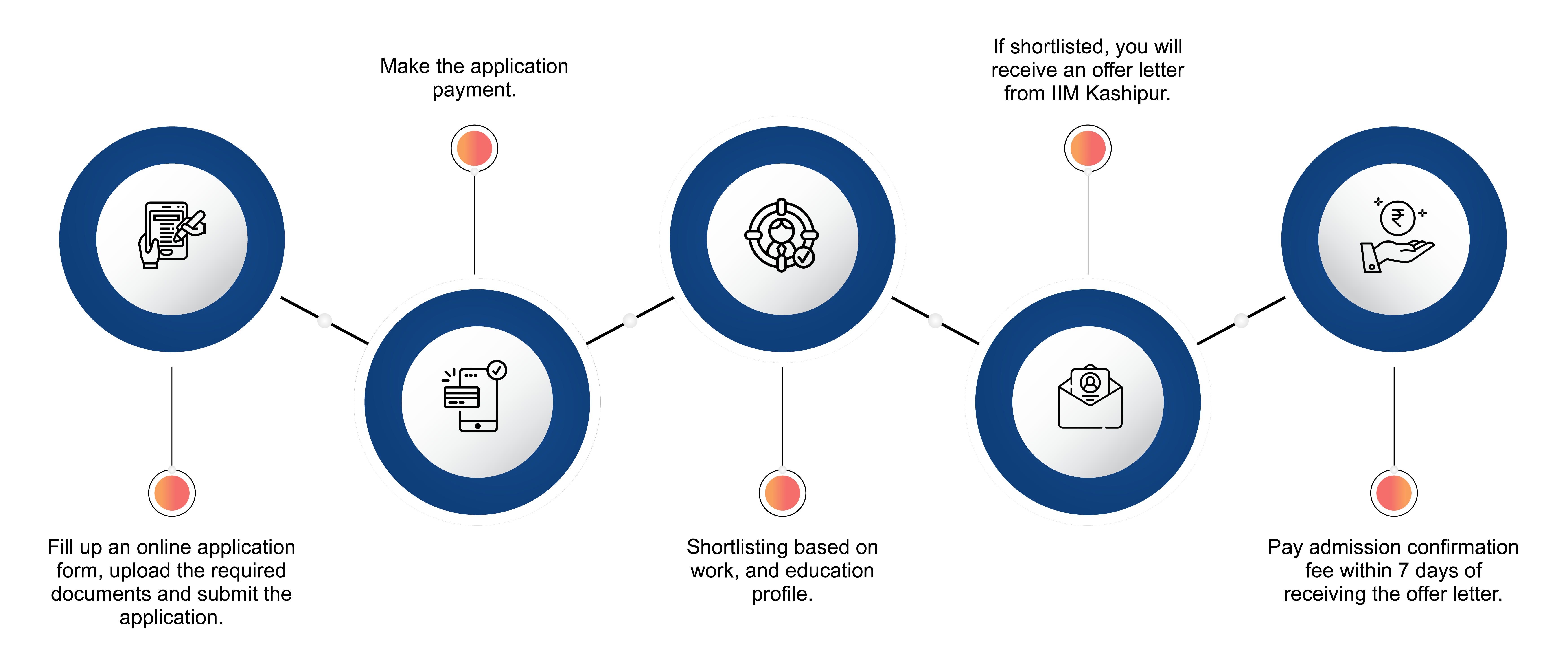

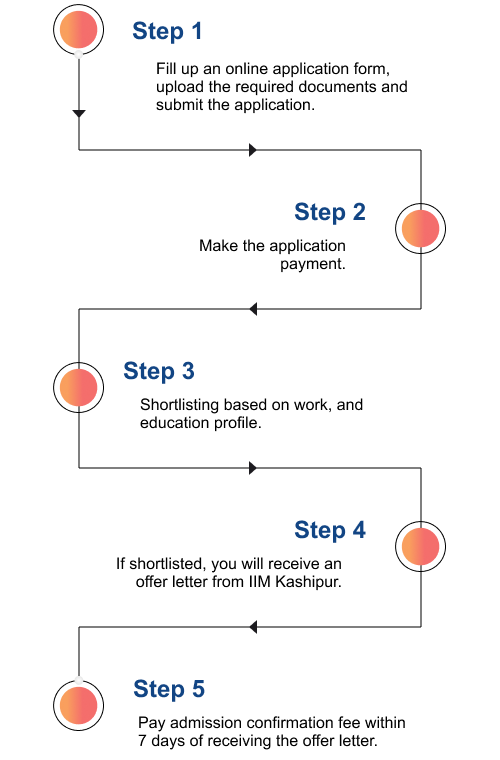

Admission Journey